AFCON 2025 Apparel Landscape: Culture and Market Trends

Judith Macharia

January 20, 2026

AFCON 2025 highlighted the growth of African football within the broader sports economy, including the apparel sector. The tournament demonstrated progress in local manufacturing and design, signaling potential for sustained engagement and commercial participation across the continent

AFCON 2025 has demonstrated the growth of African football within wider commercial systems of the sports economy, including the apparel market. The tournament is increasingly positioning itself as a commercial testing ground within the global sports apparel economy. At the national team level, the apparel market reflects the influence of commercialisation, federation procurement structures, production capacity, and evolving ideas around identity and representation.

AFCON 2025 highlights a maturing apparel landscape operating within a hybrid apparel market. The market is dominated by global brands, supported by a growing presence of mid-tier international suppliers, while African-owned brands are emerging from the sidelines to take on a more visible presence in the apparel market.

Global Brands Still Dominate, but the Market is Narrowing

Global brand, Puma had a multi-team presence across Morocco, Egypt, Ivory Coast and Senegal, while Nike and Adidas retained their partnerships with Nigeria and Algeria respectively. Their presence has supplied federations with strong commercial leverage and international visibility. This concentration is consistent with AFCON 2023, where Puma held the strongest multi-team presence (4), but in 2025 it is complemented by a more defined middle tier of international brands such as Macron, Umbro, Kappa, Lacatoni, and Le Coq Sportif, each serving specific federation profiles rather than appearing as one-off arrangements. While this does not necessarily indicate long-term strategic alignment, it does point to a market that is less fragmented than in earlier editions. Compared to the diversity observed in AFCON 2023, AFCON 2025 reflects greater structure and intent across the apparel ecosystem.

African Brands Move from Symbolic to Structural Participation

Within this evolving landscape, the participation of African-owned brands stands out as one of the tournament's most significant developments. Brands such as Tovio (Burkina Faso), Janzi (Uganda), Sandaland (Tanzania), AB Sport (Sudan), KoPa (Zambia), and All Kasi (Botswana) collectively represent a distinct and growing segment of the AFCON 2025 apparel market. Their involvement signals improvements in local design capability and stronger coordination of production and supply, sufficient to meet federation requirements related to compliance, delivery timelines, and visual identity at a continental level, even as overall scale remains constrained.

From Templates to Identity: Design as Strategy

Running alongside these market dynamics is a broader design shift cutting across both African and global brands, that is, a more deliberate emphasis on cultural and national representation in kit design. Several AFCON 2025 kits incorporate locally recognisable colours, patterns, and symbols, reflecting a move away from generic templates toward culturally grounded design that references history, heritage, and identity. Importantly, this approach is no longer limited to African suppliers; global brands are increasingly adapting their design strategies to represent local contexts. In this context, kits function not only as performance apparel, but as cultural exports, retail products, and soft-power assets within global sports commerce.

Nigeria's partnership with Nike illustrates this pattern clearly. The AFCON 2025 kit reintroduces retro design elements and draws on the Nike x Nigeria throwback campaign featuring Jay-Jay Okocha, positioning the kit as a lifestyle product with relevance beyond the tournament itself. This strategy targets diaspora and global retail markets more intentionally than in previous editions. Morocco's kit similarly integrates Amazigh symbols inspired by ancestral tattoos, embedding cultural references within a contemporary design framework. Burkina Faso's kits, produced by Burkinabe brand Tovio, combine national colours with structured colour blocking and patterns drawn from local textiles, giving the kit a stronger and clearer national visual identity. Botswana's All Kasi kits incorporate traditional Setswana patterns, reflecting national heritage and identity. Across suppliers, kits continue to function as markers of heritage and belonging, strengthening emotional connection with fans while enhancing commercial value. This reflects a broader shift within sports apparel toward storytelling and stronger representation.

Taken together, the presence of African brands across multiple teams at AFCON 2025 signals growing credibility within the continental apparel ecosystem. It highlights tangible progress in local manufacturing and design and suggests the potential for more sustained participation, provided underlying structural constraints can be addressed. As African brands gain visibility on major sporting stages, questions of production scale and distribution move to the foreground. Capturing meaningful economic value will depend not only on design capability, but on the ability to manufacture at scale and access wider markets. This is where trade and industrial frameworks become critical, not as abstract policy tools, but as practical enablers of growth within the apparel ecosystem.

Trade, Scale and the AfCFTA Question

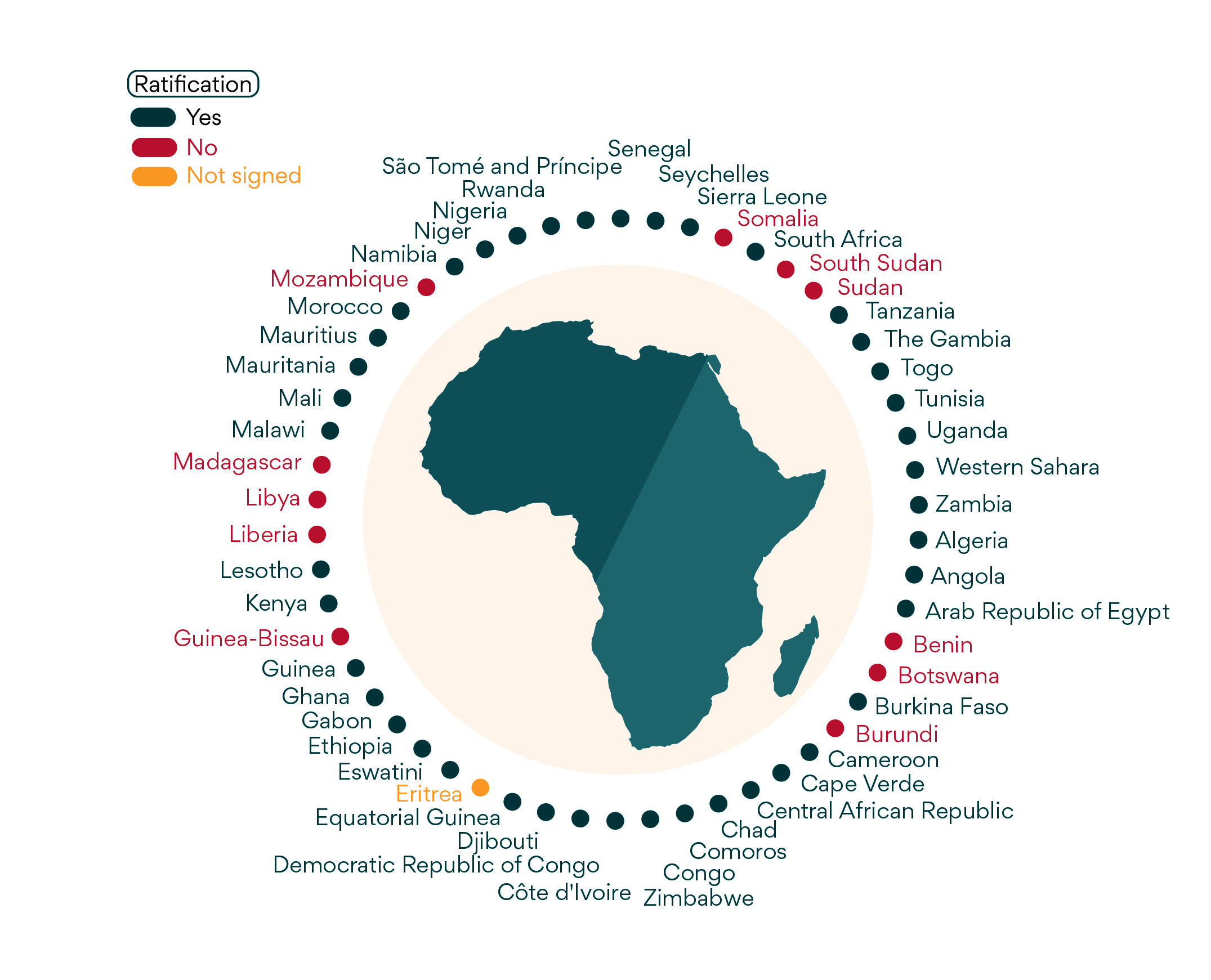

In this context, the African Continental Free Trade Area offers a pathway to better connect design, production, distribution, and market access. Reduced trade barriers and stronger regional supply chains could support higher production volumes, enable cross-border distribution, and lower operating costs for brands serving multiple African markets. In parallel, licensing and merchandising frameworks could open access to continental and diaspora retail markets, helping address persistent constraints related to scale, capital, and reach.

For example, a brand producing in East Africa could supply multiple national teams across Southern and Central Africa under reduced tariffs, while leveraging regional logistics hubs to serve both continental and diaspora retail markets.

These opportunities, however, remain difficult to realise without stronger institutional coordination. The absence of a centralised CAF merchandising and licensing framework continues to fragment apparel supply and limits demand aggregation across federations and tournaments. Aligning CAF's commercial strategy more closely with AfCFTA objectives would allow tournaments such as AFCON to function not only as sporting events, but as platforms for industrial participation and market development. Consolidated demand, coordinated manufacturing, and integrated distribution could significantly increase African brand participation in future tournaments while reducing our heavy reliance on imports.

AFCON 2025 signals a shift in Africa's football apparel market. Cultural references in kit design are more intentional, African brands are more visible, and the apparel market shows greater structure and continuity than in previous editions. The trajectory of the market will depend on stronger manufacturing capacity, coordinated commercial systems, and supportive regional trade frameworks. How effectively these elements align will determine the role future tournaments play in positioning Africa within the global sports apparel economy. AFCON's future impact will not be defined solely by who wears the kits, but by who captures the value behind them.

The observations from this article are taken from the AFCON 2025 Overview Report. Download for Free.

Related Posts